Ct State Income Tax Rates 2025. Like the federal income tax, the connecticut state income tax is progressive, meaning the rate of taxation increases as taxable income increases. As part of the state budget bill, h.b.

Enter your details to estimate your salary after tax. Find out how much you’ll pay in connecticut state income taxes given your annual income.

Governor lamont announces connecticut income tax rates go down, earned income tax credits go up, senior pension exemptions expand at the start of.

Connecticut State Tax Rate 2025 Golda Emlynne, For tax year 2025, the 3% rate for the lowest tax bracket will decrease to 2%. Use form ct‑1040es , estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2025 by mail.

Connecticut State Tax Rate 2025 Lyndy Loretta, More than a dozen cities, two states and washington, d.c., raised their minimum wage on july 1 amid an increasing cost of living. Connecticut state income tax calculation:

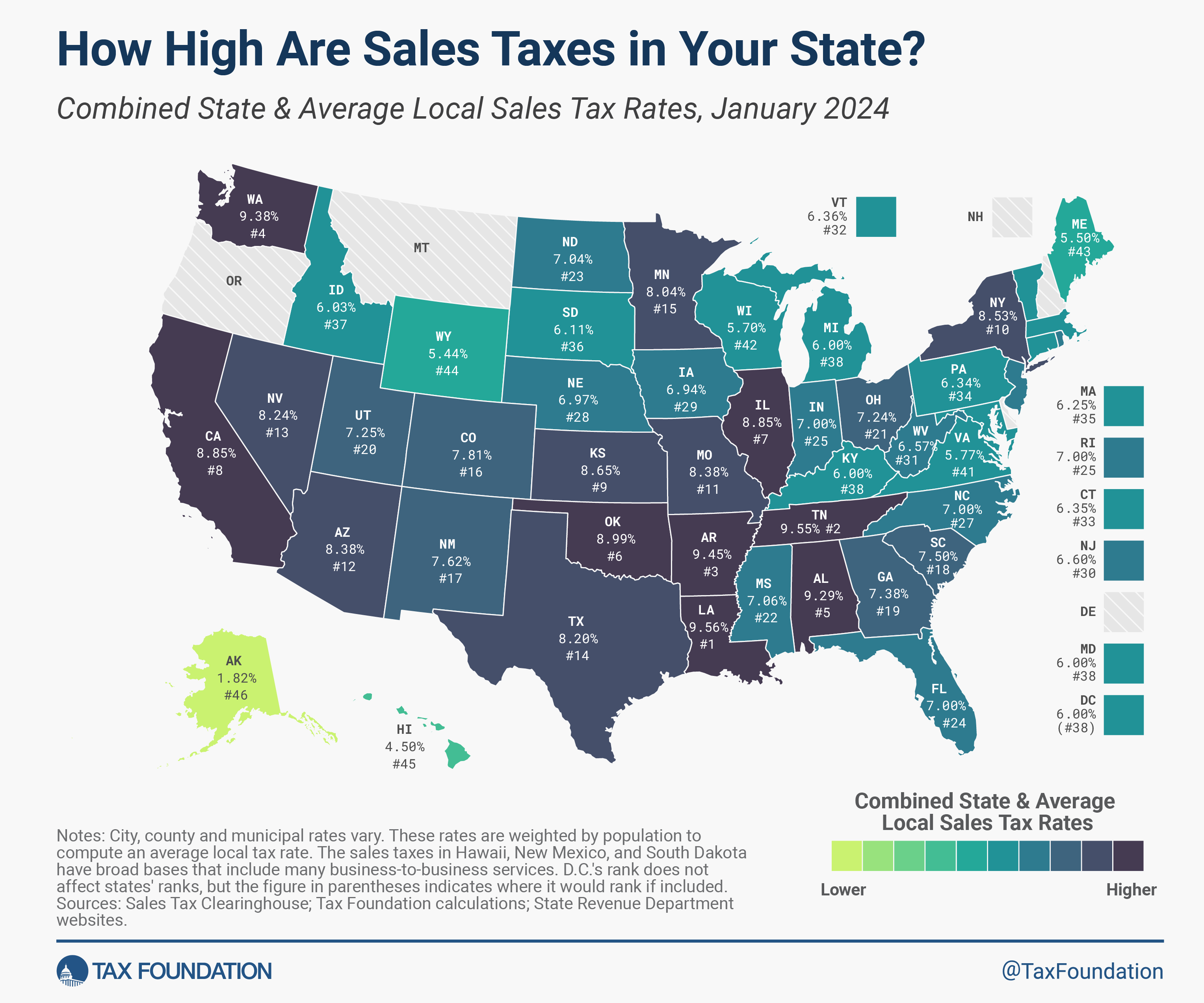

Connecticut Tax Tables 2025 Tax Rates and Thresholds in Connecticut, Find connecticut or ct income tax rates by which your income is calculated. Compare relative tax rates across the u.s.

2025 Tax Brackets Us Margo Sarette, Connecticut could generate another $92 million annually by levying a 4% conveyance tax on the portion of any housing sales that exceed $1 million, the report. Estimate your tax liability based on your income, location and other conditions.

Tax rates for the 2025 year of assessment Just One Lap, Governor lamont announces connecticut income tax rates go down, earned income tax credits go up, senior pension exemptions expand at the start of. Estimate your tax liability based on your income, location and other conditions.

Opinion A fair tax share for all in Connecticut, The following calculators are available from myconnect. It also includes fringe costs for.

Ca State Tax Brackets 2025 Bobbi Chrissy, It also includes fringe costs for. Compare relative tax rates across the u.s.

How Much Does Your State Rely on Individual Taxes?, Customize using your filing status, deductions, exemptions and more. With the upcoming union budget 2025, taxpayers and financial experts are eager to know if new tax deductions will be.

Tax payment Which states have no tax Marca, State income tax bracket range from 3% (of up to $20,000 of taxable income for married joint filers and up to $10,000 for single filers) to 6.99%. Estimate your tax liability based on your income, location and other conditions.

2025 Sales Tax Rates State & Local Sales Tax by State, Connecticut's 2025 income tax ranges from 3% to 6.99%. For tax years beginning on or after january 1, 2025, the connecticut income tax rate on the first $10,000 and $20,000 of connecticut income earned by single filers.

With the upcoming union budget 2025, taxpayers and financial experts are eager to know if new tax deductions will be.